Investors thinking about investing on something that has an aesthetic value have many options to go for. The market offering alternative investments consists of many such assets that are appealing to those who admire exquisiteness. Such people can consider investing in valuable jewelry, masterpiece paintings, vintage wines and classic cars. The last in the list has proved to be a profitable investment option.

Classic cars are fetching millions of dollars to investors. Though a classic car investment would not yield a return of 10,000% over 24 years, or 416% per year, but it would yield about 31.47% return year-to-date. This return is higher than the returns from other popular collectibles like coins, stamps, art, wine and gold. It is even better than the returns offered by S&P 500, which yielded 22% this year.

Classic Car Investments are Quite Profitable

Appreciation of Automobile Investments:

Automobiles are admired by people as art forms. People are quite excited to collect various types of automobiles. A car can be used for travelling different places. A car can act as your passport to enjoyment and adventure. Studies show that classic cars have performed well in terms of appreciation of value. The financial crisis has helped the collectible markets and classic cars.

However, the growth rates of classic cars have not been sustainable over the long term. So, you need to think well before investing in such cars.

Reasons Driving Demand of Classic Cars:

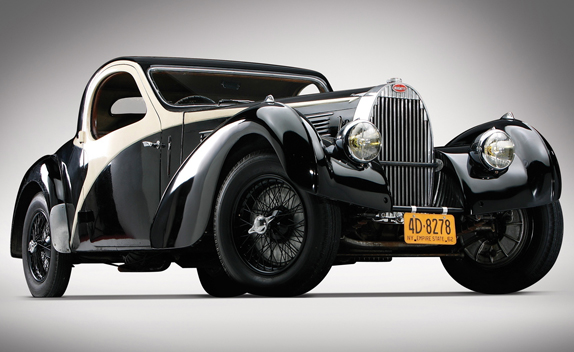

The main reason behind the high demand of classic cars is the unique attributes of such cars. Classic autos have three unique characteristics – fun, passion and rarity.

Any make or model of an automobile is not produced always. It is manufactures in limited supply. When the manufacture of a certain automobile model is discontinued, any surviving specimen of that model becomes valuable since it is one of the last of that model and hence is rare. So, cars are more limited than gold, which is always dug up and stocks, which always get printed.

Auto enthusiasts have a passion for classic cars since the cars are equipped with craftsmanship, elegance, flare and style, in spite of being produced in mass. This emotion of the car enthusiasts towards such classic cars has significantly driven up their price.

Finally, classic car can offer you a lot of fun. You can travel to different places by driving such a car. On the other hand, you cannot drive shares, or any other asset. You can show your amazing car to your friends and let them admire it. You are also going to enjoy when a passersby would admiringly watch your car. You can get many friends because of your car, and it can be the reason for you to meet different people belonging to different places. This enjoyment and the social side associated with a classic car are factors which add to their value.

Conclusion:

Hence, classic cars are a good way to make money. With investors around the world constantly looking for alternative ways of investment, classic cars can soon become a common investment. Considering the high demand for such cars, they may help you to make high profits.

Summary: Classic cars have shown better performance than other investment types. Classic car investments can yield better returns than many traditional investments.

Author’s Bio: James Patrick is a guest blogger who loves to write on various types of investment like automobile investment. He suggests seeking the services of Pacific Tycoon to invest in hard assets like shipping containers. His articles are very informative and useful to the readers.